- Indie CPG

- Posts

- Brand Prix: History of Indie Food & Beverage M&A

Brand Prix: History of Indie Food & Beverage M&A

450+ deals across 25+ years

Everyone is a Winner in the Brand Prix

My goal with this report is to visualize the history of what type of F&B products were acquired in the last 25 years, who’s buying indies, and what can we learn from the data?

Through each time period you might learn:

What’s the Big Deal?: Notable large deals in that year or cluster of years.

Brands Buying Brands: Chobani, Suja, Stryve, Nature's Path, KIND, WhiteWave all bought other brands to strengthen their platforms.

Jumping Aisles: If a brand has a diverse product portfolio, like Siete with chips, sauces, and cookies. Or Kodiak Cakes with pancake mixes and frozen waffles.

Corporate Buyers: PepsiCo, Hershey, Hain Celestial, Coca-Cola, Unilever, Danone, General Mills, ConAgra, Mondelez, Nestlé, B&G Foods and Mars all have 5+ deals in this report, ranked by # of deals in the report overall.

Emerging Buyers: Next in Natural, Our Home, UpSnack Brands, SYSTM Foods, HumanCo, Generous Brands

Founder Buy Backs: Like Krave jerky and Zico coconut water

International Players: Daydaycook, Tilray, Morinaga bought US based brands.

Mergers: Like NextFoods bringing together GoodBelly x Cheribundi

Read the full report via an Indie CPG Quarterly Pass ($75) or Annual Pass at $300/year.

What Gives a Brand Acquisition Energy?

In 2024, I was a guest on my friend Mike Gelb’s podcast, The Consumer VC, where we spoke about our outlook on M&A on both sides of the table for indies and buyers.

Listen to the full episode here - some of the topics we covered include:

Why does a company acquire another company?

Recent history of the notable acquisitions in CPG

What makes a brand attractive to a prospective buyer

Acquiring an opportunity vs. a threat

The change in buyer profile and different types of acquirers

Why smaller brands are acquiring other small brands

What was important 5-10 years ago that a company must have in order for a brand to be attractive to a acquirer

Timing the acquisition

We Were Both Young When I First Saw You

How many of these acquired brands do you remember from your childhood: Kettle Chips, Izze, Annie’s, Morningstar Farms, Ben & Jerry’s, Pirate’s Booty, and Silk? When I started to study CPG in 2017, I’d roam the aisles of Whole Foods wondering…if those brands are still on the shelf, maybe they’ve been acquired? I was wrong half the time.

Methodology & Transparent Sources

Data in this report was compiled through eight years of original research, BevNet and Nosh articles, press releases, LinkedIn company verified posts, and buying my own groceries for the last 18 years. All deals are publicly confirmed.

Companies featured are not 100% organic. You might see BODYARMOR, Rockstar, or Vitamin Water that helped shape their category with exits worth studying if you’re building or investing in that aisle.

Aisles covered focus on Beverages, Snacks, Bars & Sweets, Pantry, Fridge & Frozen.

Terms of the Deal Were Not Disclosed

Omissions were not intentional and exit prices are not noted, though you can Google around if you’re curious about a few. If I missed a deal, let me know and I’ll reward you.

We will continue to update this report as new deals or insights emerge from the data.

Moxie Sozo x Indie CPG Zine from Expo West 2025

In March, we partnered with Moxie Sozo to design a zine featuring some of the M&A data in this report. Moxie Sozo is an independent strategic branding agency empowering brands to make bold decisions, enabling them to succeed on shelf and grow their market share. They’ve been working in CPG since 1999 - you can see some of their packaging work throughout our report with their past or present clients: Aura Bora, Suja, Kodiak Cakes, Birch Benders, and Ancient Nutrition.

Travel Back in Time with the Brandelorean to See Notable Deals of the Last 25+ Years

M&A in 2025 so far is a free sample, buon appetito! After reading this year’s deals below, Upgrade to read the full report via a Quarterly Pass ($75) or Annual Pass ($300).

Journalists covering CPG can request a media pass → [email protected]

What’s the Big Deal?

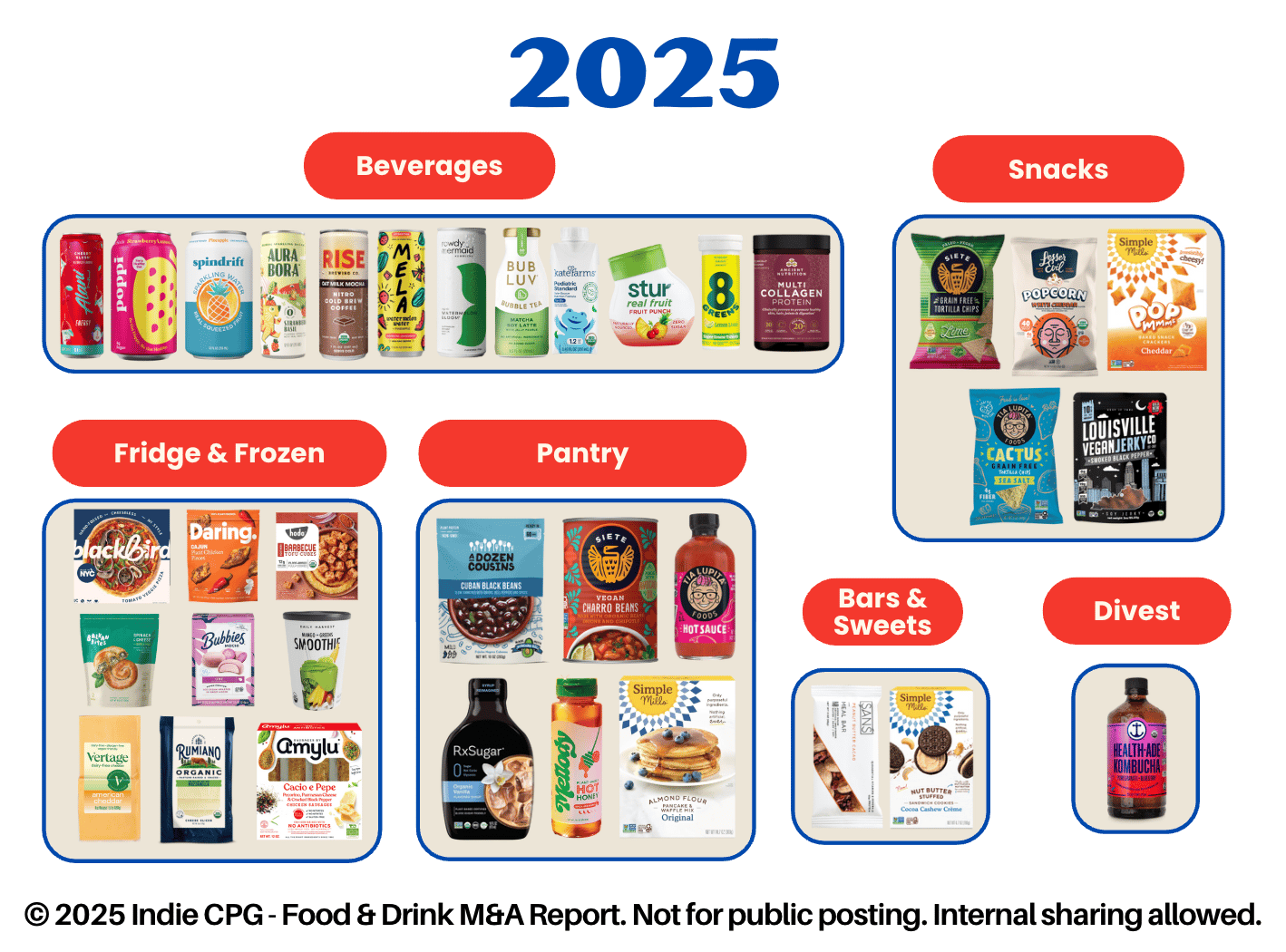

Poppi → PepsiCo

Alani Nu → Celsius Holdings

Spindrift → Gryphon Investors

LesserEvil → Hershey

Siete Foods → PepsiCo

Simple Mills → Flowers Foods

Daily Harvest → Chobani

Kate Farms → Danone

Brands Buying Brands: Celsius bought Alani Nu, Chobani bought Daily Harvest, UPTIME bought RISE Brewing Co., Verde Valle Foods bought A Dozen Cousins, Misha’s bought Vertage, Bearded Brothers bought SANS Meal Bar.

Jumping Aisles: Siete Foods, Simple Mills, and Tia Lupita all play in multiple aisles. Daily Harvest helps Chobani enter the frozen space with savory meals and smoothies that complement their yogurt business for breakfast consumers. Health-Ade also operates a functional soda sister brand called SunSip.

Corporate Buyers: PepsiCo, Danone, KDP, Calbee, Marubeni, Flowers Foods, Hershey

Emerging Buyers: Next in Natural, Ahimsa Companies

International Players: FOODYOUNG Group (Switzerland), Calbee and Marubeni (Japan), v2food (Australia)

Beverages

Snacks

| Pantry

Fridge & Frozen

Bars & Sweets

|

Want to see 400+ more M&A deals in this report? 👀

Subscribe to our new Annual Pass ($300/year) to access monthly premium content including reports and original insight backed by Amrit’s deep consumer goods research since 2017. We practice what we eat: 88% of acquired brands in this report that launched in the last 15 years were in past Indie CPG content, some since their launch.

Annual Pass holders can reply and discuss premium content over email and help shape future reports. Our content is fueled by ongoing analysis of thousands of indie brands, acquisitions, buyers, and investors in the game. Brandelorean = whey back machine.

Looking for intel on an aisle or trend? Hire me directly for research via Supermercato.

Buy an Indie CPG Annual Pass to read the rest.

Email [email protected] with any questions.

Already a paying subscriber? Sign In.